Introduction to Fintech Infrastructure: the Rails of Financial Innovation

Defining fintech infrastructure

Fintech companies and established financial institutions around the world are redefining the boundaries and delivery of financial services, creating products and solutions that simplify customer interactions, enhance security, and optimize efficiency.

At the heart of this transformation lies fintech infrastructure, a backbone of technologies and systems that enables the development and delivery of innovative financial products via mobile devices and online. The term “fintech infrastructure” covers the essential tools and technologies — hardware, software, networks, and protocols — required for creating, storing, and transmitting financial data and completing transactions online efficiently and securely.

Specialized fintech firms, and a few traditional financial institutions, provide the essential components of fintech infrastructure to financial and non financial entities, which ultimately use them to build applications that incorporate financial products in their offering.

Whilst it shares some similarities with legacy financial system infrastructure, the components of fintech infrastructure differ substantially.

Fintech infrastructure vs. financial infrastructure

The traditional financial infrastructure encompasses all the systems and procedures facilitating the provision of financial services via physical channels. Conversely, the fintech infrastructure empowers the delivery of financial services digitally, making them accessible through online platforms and mobile devices and eliminating the need for physical locations.

The main constituents of the traditional financial infrastructure include bank branches, physical payment processing systems, ATM networks, the SWIFT network and the card payments networks.

The components of fintech infrastructure, instead, are multiple and in constant evolution, shaped by the transformation brought by trends like Open Banking and the API-fication of financial services.

Open Banking, APIs and the emergence of fintech infrastructure

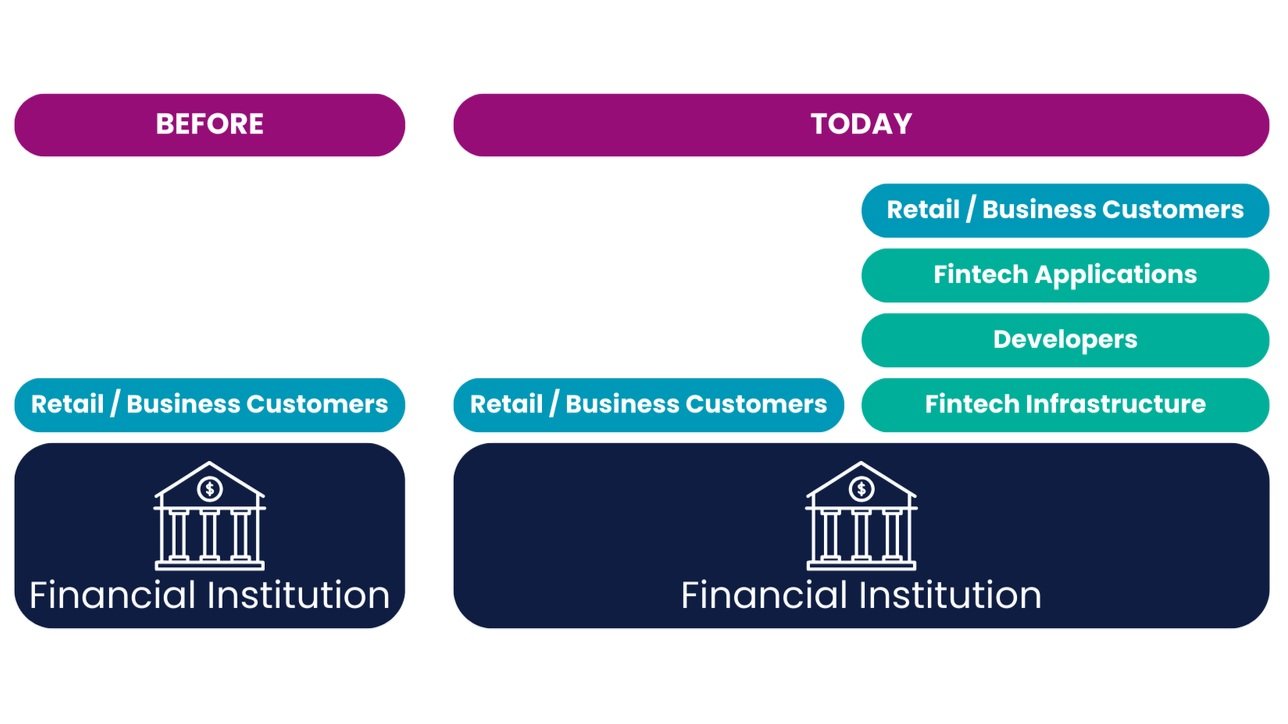

In the old financial services paradigm, financial institutions were large monolithic organizations that served the entire suite of financial products to all of their customers, whether retail or businesses. To do so, they relied on a closed architecture of internal systems and infrastructure supplied by external providers, which included components such as core banking infrastructure, KYC/AML, card networks, and many more. Data remained in a closed circuit, being shared only among the financial institution and its suppliers.

As fintech gained prominence, a plethora of online financial applications emerged, each catering to various customer needs previously exclusively served by traditional banks. As a result, a fresh category of bank customers emerged alongside traditional retail and business customers: developers of fintech applications. These developers not only seek access to the data provided by financial institutions but also to their core functionalities. To streamline this access, specialized fintech companies have emerged whose function is to connect developers and financial institutions. These companies constitute the building blocks of fintech infrastructure.

Comparison of banking customers before Open Banking / APIs and today.

Before the emergence of fintech infrastructure, establishing a partnership with a bank or a traditional financial services provider to kickstart a new fintech venture typically required a lengthy process. However, today, using fintech infrastructure, developers can swiftly launch new fintech applications within a matter of hours. These fintech infrastructure companies simplify the intricacies of collaborating with various financial partners, enabling all kinds of applications to integrate fintech services into their products. They do so by providing white-label, API-based “as-a-sevice” products that allow other fintech and non-financial companies to quickly embed financial products into their offering. Fintech infrastructure encompasses a multitude of companies providing data aggregation, KYC/AML, banking-as-a-service, lending-as-a-service, card issuing, and many more.

Examples of fintech infrastructure companies (non-exhaustive)

Drivers and uses of fintech infrastructure

It is nearly impossible to map all the different components and uses of fintech infrastructure, and sometimes definitions are blurred. But broadly speaking, the use of fintech infrastructure by financial and non-financial entities is driven by different factors.

For non-financial entities, a quest for new monetization channels and improved customer retention are the main propulsions behind the integration of fintech into their offering. Brands entering financial services include telecoms, airlines, retailers, e-commerce platforms, and more. From e-commerce platforms like Shopify integrating payment processing and financing solutions to automakers such as Mercedes-Benz embedding in-car payments in vehicles, the landscape is evolving rapidly. Industry giants like Uber and Walmart are also capitalizing on their extensive user bases to establish comprehensive financial ecosystems that drive increased loyalty and generate new revenue streams.

In financial services and fintech applications, instead, fintech infrastructure supports a range of old and new products. For example, in banking it enables online and mobile banking, peer-to-peer payments, digital wallets, and contactless payment systems. In wealth management, it powers automated investment platforms and algorithmic trading systems. In insurance, companies leverage fintech infrastructure for faster underwriting, claims processing and risk assessment. In capital markets, fintech infrastructure facilitates digital trading, crowdfunding, and cryptocurrency exchanges.

Benefits of fintech infrastructure

The emergence of fintech infrastructure has brought several benefits in terms of accessibility, cost efficiency, innovation, and convenience of financial services.

First and foremost, it has democratized financial access, transcending geographical boundaries and enabling an ever increasing number of individuals and businesses to engage with financial services through the proliferation of consumer and business applications.

Thanks to its impact in streamlining the operations of fintech platforms globally and its economies of scale, the use of fintech infrastructure has led to significant cost reductions, paving the way for lower fees and enhanced affordability for consumers.

Simultaneously, the deep specialization of firms operating in fintech infrastructure has fueled a wave of innovation, propelling the development of bespoke financial products and services tailored to better meet old and new needs of customers. From advanced credit assessment algorithms to automated payroll verification, fintech innovations are driving the industry forward, enhancing the overall customer experience.

Finally, the real-time processing capabilities inherent in fintech infrastructure ensure swift and efficient financial transactions, underscoring its role as a catalyst for convenience and access.

Fintech infrastructure in India

The fintech infrastructure landscape in India is undergoing a rapid expansion, with a multitude of fintech infrastructure startups entering the market, with far-reaching implications both domestically and globally. This transformation is sustained by various favorable factors, including the proliferation of large consumer distribution platforms, regulatory clarity, the success and innovation of digital public infrastructure initiatives, and increased technological adoption by financial institutions.

The national payments infrastructure, Unified Payments Interface (UPI), for example facilitates more than $1.5Tn in annual payments across 350mm users and 50mm merchants in India. With over 700 million new users projected to engage in online transactions, valued at over $4Tn by 2030, embedding financial products into transaction journeys presents a significant opportunity to enhance accessibility, drive efficiency, and improve customer experiences. Large and small brands in commerce will increasingly integrate fintech in their offering and the demand for infrastructure across numerous niche categories is poised to escalate significantly. Even apparently minor niches within the digital sphere, especially those intertwined with financial domains, harbor the capacity to command billions of dollars within the total addressable market.

In response to growing competition, Indian fintechs, financial institutions and businesses are compelled to deliver superior products and experiences, requiring the adoption of cloud-native systems and modern technology infrastructure. Meanwhile, the integration of digital public infrastructure with fintech infrastructure streamlines data access and customer acquisition, empowering banks, fintech and businesses to enhance customer analytics, accelerate time-to-market, and reduce operating costs - all factors that will play a pivotal role in growing the importance of fintech infrastructure to the entire business ecosystem.

Sources: Emphasis Ventures (EMVC), CB Insights, Economic Times, Contrary Research, RBI