Our portfolio company and a fintech API infrastructure platform, M2P, raised ~$2.7mm from Visa as a part of its ongoing Series C1 round led by Insight Partners.

Read MoreOur portfolio company Monnai, which is an infrastructure platform for global financial institutions raised $3.15mm in seed capital from Better Tomorrow Ventures, Commerce Ventures and others.

Read MoreEMVC portfolio company Jar, which is an investment platform for financial products including digital gold, raised $22mm led by Tiger Global.

Read MoreEMVC portfolio company, Tartan, which provides payroll APIs to SMBs and enterprises in India raised $4.5mm led by 500 Global, InfoEdge and others.

Read MoreEMVC portfolio company CARD91, which is a global card issuance platform for businesses, raised $13mm led by investors including Point72 Ventures, Infinity Ventures and Sabre Partners.

Read MoreEMVC portfolio company Wealthy, which is a tech platform for independent wealth management professionals, raised $7.5mm led by Alpha Wave Incubation.

Read MoreEMVC portfolio company Jar, which is a micro savings and investment platform for investing in financial products like digital gold, raised $32mm led by Tiger Global.

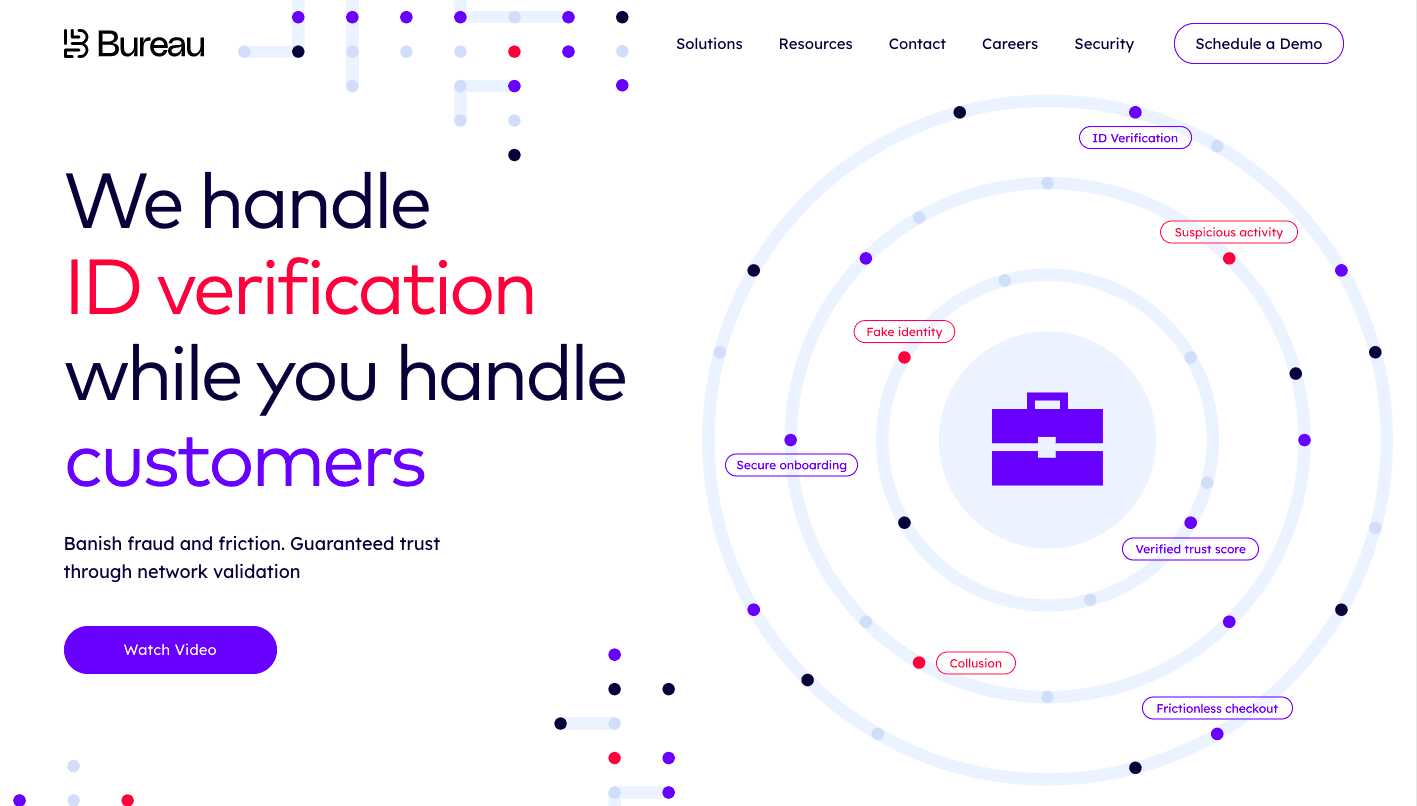

Read MoreEMVC portfolio company Bureau raised $12mm in its Series A round from Quona Capital, Commerce Ventures, Okta Identity and top-tier angels.

Read MoreEMVC portfolio company Slice, which offers credit cards and BNPL services for new-to-credit millennial and genZ individuals, raised $220mm from Tiger Global, Insight Partners, Advent International and others at a valuation of $1Bn+.

Read MoreOur portfolio company Clinikk, which provides subscription based primary healthcare and health insurance, raised $4mm led by Mass Mutual Ventures.

Read MoreEMVC portfolio company Gramcover, which is a full-stack insurance distribution platform for rural India, has raised $7mm in its series A funding round.

Read MoreEMVC portfolio company Khatabook, which has a suite of accounting and payments apps for small businesses, raised $100mm led by Tribe Capital and Moore Strategic Ventures.

Read More